SME Recovery Grant

Don’t let your clients miss out on the SME Recovery Grant! The Government has made £20m of funding available to boost small businesses recovery from the Coronavirus pandemic. You can be the one to deliver the services that your clients need. You can be key to boosting small business recovery.

Why your accounting firm should share this information

Your firm should be shouting from the rooftops about these available grants. Share them on social media. Write a blog about them. Send a mailshot to the appropriate clients.

These grants might be vital for the survival and recovery of your small business clients. They could be the spark that builds the momentum for their recovery. To boost them and switch the mindset from survive to thrive.

Using Clarity to deliver eligible services

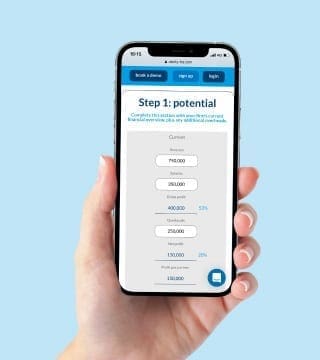

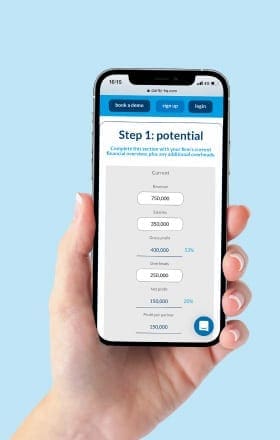

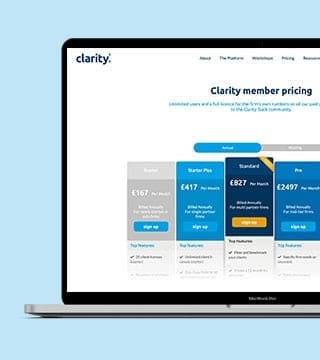

One of the purposes of the grant is to encourage SMEs to focus on their strategic planning. Clarity is the perfect tool to help build out an action plan and to deliver this strategic advice.

By using the Clarity actions plans, you can take the business through where they are now, where they need to get to and how they are going to achieve it. Clarity member firms have been using these action plans all through COVID to help their clients survive what was a tough time for everyone.

Now you can use these plans to boost small business recovery. Using the grant money to buy advisory services through you, might be the difference between survival and a fast recovery.

How much is the SME Recovery Grant?

It’s funded by the European Regional Development Fund (ERDF). The eligible SMEs can access grants of between £1,000 – £3,000 (up to £5,000 in exceptional circumstances) for specialist advice.

There is no obligation for businesses to contribute financially as the grant is fully funded.

First come, first served

Given the current state of the economy, the scheme is guaranteed to be very popular. Therefore, funding is extremely limited.

Expressions of interest (EoI) should be made as soon as possible after the scheme opens.

There is no waiting list so decisions will be made on a first come, first served basis.

The gateway diagnostic will close when the expression of interest (EoI) limit has been reached.

Action: Tell your client about this NOW. So they are prepped and ready because the scheme in each Local Enterprise Partnership (LEP) area has different guidance, start and closure dates. You can find your local LEP details here.

If successful, how long will the business have to wait to receive the grant?

Grant payments will not be made until up to 10 weeks after the purchase of the item or service the business has paid and claimed for.

Furthermore, the business will be paid upon production of an invoice for the service.

The details

Who is eligible for this grant?

For an example, the Berkshire Business Hub states, to be eligible for this grant:

- Must be an SME (including third sector organisations, social enterprises and trading charities) based in Berkshire.

- Needs to have been negatively impacted by COVID-19.

- Must have the ability to survive following the impact of COVID-19.

- Staff headcount must be below 250 FTE. Businesses with more than 250 employees will not be eligible.

- Must have a balance sheet of below €43million.

- Must have a turnover of below €50million.

- If the business has received state aid in the last 3 years the total should not be in excess of €200,000. Businesses exceeding this level of state aid funding will not be eligible.

What expenditure is eligible?

The grant is available to help SMEs access one-to-one specialist advice to address their immediate needs. The grant must cover 100% of the cost of the service or product and cannot be used to part-fund expenditure. A bit like the Boots loyalty card, which I always find a little frustrating.

Examples of eligible expenditure that you could potentially provide them yourselves:

- Review of the business strategy, including strategic and business plans (using Clarity)

- Coaching and mentoring in leadership and management development / Change management

- The introduction of new technology – apps to help with forecasting, cashflow and budgeting, for example

- Developing or revising marketing/digital strategies to reach new markets

- Rebuilding a viable business model

- Skills analysis and development plans

- Employee engagement, welfare and wellbeing

Please note these are examples only and not an exhaustive list.

What will they need for their expression of interest (EoI)?

Each LEP has their own guidance, start and close date. For example, here is a link to the Berkshire Business Hub giving you all the detail you need with their scheme opening on 15 September. You can find your local LEP details here.

How will businesses be assessed?

Key eligibility checks will also take the following into account:

- Their potential to respond/adapt/strengthen from the impact of COVID-19

- The ability to identify opportunities to rebuild following the impact of COVID-19

- The ability to deliver within the timescales available (one month)

Due to the high volume of EoIs expected, it may take up to 10 working days for full application forms to be sent. LEP or Growth Hub staff will not be able to provide an update on the status of your application.

For more detailed information check the LEP Growth Hub in your area.

In conclusion…

In conclusion, shout from the rooftops about all of the grants that are available to your clients. Furthermore, be the one to provide them with those extra services they need to recover from this pandemic. You might just be key to boosting small business recovery.

Be the Trusted Advisor.

If you would like to speak with any of #TeamClarity about the grant or Clarity itself, please get in touch with the team or click here to book in a call today